Description

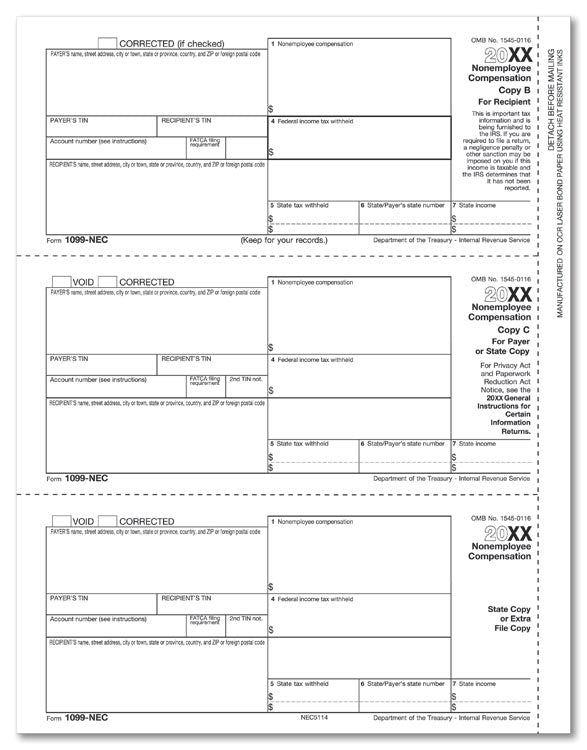

NE5114 1099-NEC Recipient Copy B Payee & ST, Copy C & STSize: 8 1/2 x 11" This popular format for reporting miscellaneous payments and non-employee compensation meets all government and IRS filing requirements. Use to Report: Miscellaneous payments such...

NE5114 1099-NEC Recipient Copy B Payee & ST, Copy C & ST

Size: 8 1/2 x 11"

This popular format for reporting miscellaneous payments and non-employee compensation meets all government and IRS filing requirements.

- Use to Report: Miscellaneous payments such as rents, royalties, medical and health payments and non-employee compensation.

- Amounts to Report: Generally $600 or more (all amounts of $10 or more in some cases).

- State Requirements: Meets 4-part state filing requirements.

- Quality Paper: Government approved 20# bond paper.

- Compatible with laser or inkjet printers.

- To Recipient by January 31st, to IRS by February 28th

- Tax Forms Per Sheet: One filing per sheet.

- 100 per pack